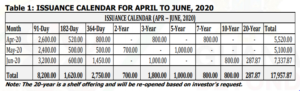

During the second quarter of 2020, government plans to issue cedi-denominated domestic debt securities that target a gross amount of GHc 17, 957.87 million from the domestic market.

This is according to the second quarter of 2020 public debt issuance calendar issued by the Finance Ministry yesterday, and which shows the securities that are to be issued in respect of Government’s Public Sector Borrowing Requirements for the period April to June, 2020.

However, due to prevailing extraordinary circumstances brought about by the coronavirus outbreak, significant changes to the issuance calendar are certain to be made.

For now though, of the targeted amount, GHc 13,680.82 million has been earmarked be used to rollover maturing domestic debts, whereas the remaining GHc 4,277.05 million would be fresh issuance, to be used to meet government’s budgetary financing requirements.

The fresh issuance for the quarter amounts to about 27 percent of the total net domestic financing requirement in the original 2020 budget, of about GHc 15,849 million.

However, because of the profound effects of the coronavirus pandemic on Ghana’s public finances, which have created a fluid, highly uncertain situation, government is now expected to update the issuance calendar on a monthly rolling basis, to reflect a full quarter financing programme.

Indeed, in July, 2020, the Finance Minister, Ken Ofori-Atta will present to Parliament a revised budget, in order to reposition Ghana’s economy to meet the global effects of the novel Coronavirus pandemic. The new fiscal policy will re-examine government expenditure to meet the revised revenue target.

Under the current 2nd quarter 2020 debt issuance calendar however, domestic portfolio investors will be able to invest up to GHc 12,570 million in short term government debt securities which are not open to foreign investors. This amount comprises debt securities with tenors of 91 days, 182 days and 364 days to be issued during the period, all of which are reserved strictly for domestic investors.

The remaining portion of the securities of GHc 5,347.87 million, comprising debt securities with tenors from two years up to 20 years, would be made available to non-resident investors as well, who have tended to dominate subscriptions of such medium to long-term issuances to date.

The calendar is based on the Net Domestic Financing provided in the original 2020 Budget, announced in November last year, the domestic debt maturities and the Medium-Term Debt Management Strategy (MTDS) for 2020-2023.

The Calendar also takes into consideration Government’s liability management programme, market developments (both domestic and international) and the Treasury and Debt Management objective of lengthening the maturity profile of the public debt.

Per this calendar, government aims to issue weekly the 91-day and 182-day bills, whereas the 364-day bill will be issued bi-weekly, through the primary auction with settlement being the transaction date plus one working day.

A total amount of GHc 8,200 million, GHc 1,620 million and GHc 2,750 million have been planned to be issued for the 91-day, 182-day, and the 364-day bills, respectively.

For securities of two years up to 10-years tenors, government will issue them through the book-building method.

An amount of GHc 700 million and GHc 1,000 million have been tentatively planned to be issued for the 2-year notes and 3-year bonds, along with a targeted amount of GHc 1,000.00 million in 5-year bonds. Totals of GHc 800 million each have been targeted through the issuance of 7-year bonds and 10-year bonds respectively.

An amount of GHc 287.87 million worth of 20-year bonds, which are expected to be issued as a shelf offering, will be re-opened based on investors request and dependent on market conditions, the statement said.

Consistent with the MTDS, government may announce tap-ins/reopening of other existing instruments.