The Monetary Policy Committee of the Bank of Ghana has decided to maintain the monetary policy rate at 14.5 percent, for a second consecutive meeting, citing the current extraordinary circumstances due to the coronavirus pandemic.

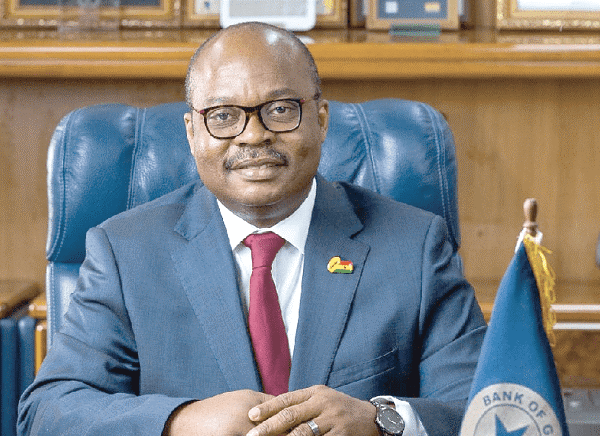

During the Bank’s press briefing following the Committee’s meeting, the Governor of the Bank of Ghana, Dr. Ernest Addison also cited the widening of budget deficit to 11.4 percent and a residual financing gap of GHc 44.1 billion, which requires some monetary restraint to preserve the anchors of macroeconomic stability.

The huge financing gap brought about by the expanded deficit could exert pressure on public debt, with long term implications for the economy, Dr. Addison said.

The stock of public debt rose to 67.0 percent of GDP at GHc258.0 billion, ending June 2020 compared with 62.4 percent of GDP at GHc 218.2 billion, ending December 2019.

BoG’s latest forecast shows that inflation is currently above its upper limit, driven mostly by food prices.

Instructively, the Governor said, “Adjusting for the unusual noise in the food inflation, the indications are that underlying inflationary pressures are stable.”

The Bank projects a return of inflation to the medium-term target band by the second quarter of 2021, conditional on corrective fiscal measures being introduced in the near-term.