The already strong liquidity coupled with decline in yields on the primary market has caused a shift in investors’ interest towards attractive deals across the various maturities on the secondary bond market.

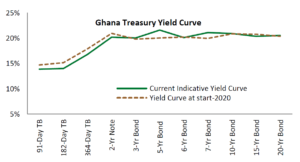

Since the close of March 2020, yields on government securities on the primary market have largely declined due to government fiscal policy to reduce interest rates priced-off the Ghana Reference Rate (GRR) by 200 basis points, along with the BoG’s directives to the banks not to move their excess liquidity to the treasury market, causing the primary market coupon rates to look unattractive to investors.

Explaining the reasons for such movement, a Senior Economist with Databank, Mr. Courage Kingsley Martey in an interview said, “This is largely because in the past weeks, primary market offers have not been giving them [investors] the desired nominal returns they seek for their fixed income portfolios. But the secondary bond market tends to have different bonds with similar or preferred terms-to-maturity but they are more attractive from a pricing perspective.”

Mr. Martey said, “We however expect more price actions for the medium-term securities on the secondary market because that’s where investors appear to be seeing some sweet spots and are therefore, exploiting attractive deals or opportunities across the various maturities on the secondary bond market.”

“Yields remain downward biased, although the pace of decline appears to have slowed down, especially at the front-end of the curve where we’ve already seen over 100 basis points decline each for the 91-day, 182-day and the 364-day bills,” Mr. Martey said.

Experts in this market are estimating that in the weeks ahead, there is limited scope for further decline in yields for Treasury-bills.

Essentially, while rates are likely to see further downward drift for the T-bills, market analysts expect a more moderate pace of decline as yields for short-term securities appear quite close to their fair valuation or bottom points.

Currently the banks and other investors do not have many options for lower tier securities given that the BoG bills also have lower yields, due to the reduction in the Bank’s benchmark Monetary Policy Rate to 14.5 percent, similar to the measure taken by government on the yields of its treasuries.

The regulatory measures taken by the Bank of Ghana during its March 2020 Monetary Policy Committee meeting, as well as subsequent measures such as the suspension of dividend payments by banks have made available large liquidity on the market.

In alleviating the potential liquidity strains, the BoG slashed its benchmark interest rate by 150 basis points on March 18 to combat the economic impact of the virus, as well as announced a reduction in banks’ reserve requirements. The limit was lowered to 8.0 percent from 10 percent. The Bank also halved the commercial banks capital conservation buffer to 1.5 percent from 3.0 percent, which effectively cut the capital-adequacy ratio to 11.5 percent from 13 percent.