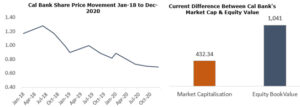

Cal Bank shares currently sell at GHc 0.69, which represents a price to book ratio of 0.4 times meaning the Bank is selling for less than half its book value or actual net worth. In theoretical sense buying Cal Bank at a price of GHc 432.34 million or GHc 0.69 per share is like buying the company at a significant discount of over 58% to its book value.

At the current price level, the expected dividend yield for Cal Bank is 12.90 percent. The expected dividend yield of 12.90 percent plus the forecasted share price increase of 44.93 percent positions holders of Cal Bank stock to gain a total return of 57.83 percent in 2021 if all go as expected and the management recommendations herein are implemented.

Even though the fundamentals of the Bank remain solid with a single digit non-performing loan ratio of 9.0 percent and a capital adequacy ratio of 20.8 percent, it is recommended for management to consider a share buy-back programme of between overall market capitalization by GHc 200 million (US$ 38 million) in the first quarter of 2021. Cal Bank can also increase its dividend payment for fiscal year 2021 to improve its dividend yield and catalyze share price growth. In addition, it is expected that the bank will capitalize on the ongoing COVID pandemic and its associated low interest rate regime to refinance/reduce its cost of capital significantly whiles increasing overall leverage ratio to boost Returns on Equity

About the Company

Cal Bank currently has a network of 29 branches and over 100 ATMs spread throughout Ghana. It is currently a market leader in SME banking and plays a dominant role in corporate & wholesale banking.

Supporting Reasons for the Purchase Recommendation

The Bank is currently among the most undervalued stocks on the GSE that can offer investors the best bargain in 2021. Below are the reasons supporting the assertion.

- Attractive Valuation or Cheap Stock Price:

Cal Bank shares currently sell at GHc 0.69, which represents a Price to book ratio of 0.4 times meaning the Bank is selling for less than half its book value or actual net worth. To explain in simple terms, the bank is currently selling at a price less than what investors can gain if the bank was to distribute its equity capital base (Asset less Liabilities) to investors today. The Bank’s current total market capitalization is GHc 432.34 million (GHc 0.69 per share), this refers to the market price at which an investor can purchase the entire company on the Ghana Stock Exchange. Surprisingly, the balance sheet equity capital, which refers to the actual amount the company possesses on its balance sheet for investors stands at GHc 1.04 billion. So, in a theoretical sense buying Cal Bank at a price of GHc 432.34 million or GHc 0.69 per share is like buying the company at a significant discount of over 58 percent. You gain ownership of an equity capital base of GHc 1.04 billion using a capital of just GHc 432.34 million. This is a perfect arbitrage that can provide a potential yield of 44.93 percent when the arbitrage resolves to a P/B ratio of 1.

- High Dividend Yield and Solid Dividend Payment History:

Cal Bank has always paid dividends with exception of 2016, when the entire financial sector witnessed a downturn. At the current price level, the expected dividend yield for Cal Bank is 12.90 percent. This represents the amount of cash dividend payment that shareholders of Cal Bank may receive by April 2021 (Cal Bank’s dividends are normally paid in April) for the Bank’s performance in 2020. The expected dividend yield of 12.90 percent plus the forecasted share price increase of 44.93 percent positions holders of Cal Bank stock to gain a total return of 57.83 percent in 2021 if all go as expected and the management recommendations herein are implemented.

- Strong company fundamentals and potential share price re-bounce:

The fundamentals of Cal Bank’s balance sheet remain solid with a single digit non-performing loan ratio of 9.0 percent and a capital adequacy ratio of 20.8 percent. This compares favorably to the industry’s NPL ratio of 12 percent and the minimum required capital adequacy ratio of 10 percent by the Bank of Ghana. The profitability of the Bank remains intact despite the Covid-19 pandemic with the bank recording a total net profit amount of GHc 140.7 million in the third quarter of 2020 and a per share earning amount of GHc 0.2996 for the same period. Cal Bank is a strategic player in the SME, corporate banking and wholesale banking space in Ghana with its dominant presence expected to continue unabatedly. Therefore, the current valuation afforded the company is not a true reflection of its strong earnings potential and value creation ability.

Disclaimer

This article was prepared by Emmanuel O. Boakye in his personal capacity. The opinions expressed in this article are entirely the author’s own. Information and opinions herein have been compiled or arrived at based on information obtain from sources considered reliable. I therefore do not hold myself responsible for its completeness or accuracy. All statement of opinion, projections, forecast, or those relating to expectations regarding future events or performance of investments represent my own assessment and interpretation of information currently available, which are subject to change.

Emmanuel Boakye holds about 15,000 shares in Cal Bank.