The Bank of Ghana has now given a timeline for the commencement of the pilot phase of its Central Bank Digital Currency (CBDC) project. Speaking to financial journalists at the end of last week at opening of a training workshop organized by the central bank and Journalists for Business Advocacy, (JBA) Dr Maxwell Afari, 1st Deputy Governor of the BoG revealed that the central bank expects to have the pilot phase of the project up and running by the end of this year.

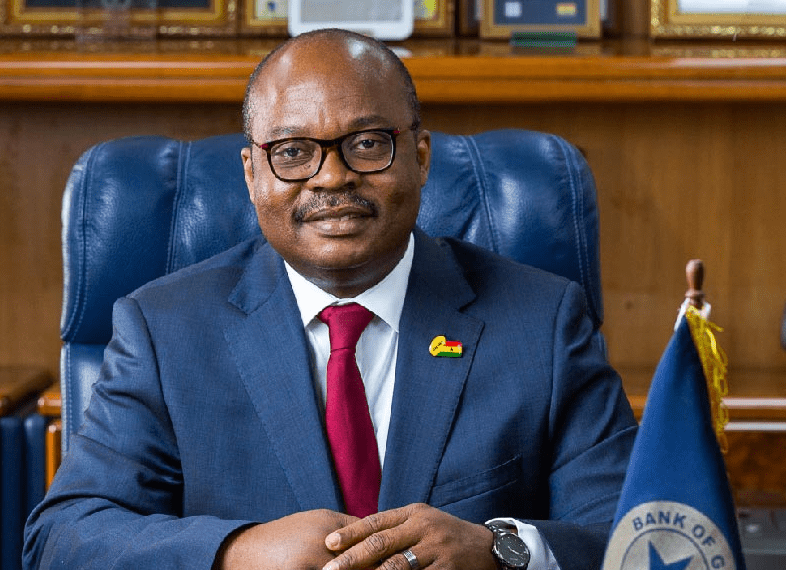

This revelation comes on the back of an announcement by the Bank of Ghana Governor Ernest Addison himself during the first week of June that the central bank is now “in the advanced stages” of introducing a digital currency.

The timeline revealed by Dr Afari puts paid to any lingering doubts as to the BoG’s commitment to pursuing its CBDC project. Initially there was a lot of sceptism as to the seriousness of the project – many emerging market economies have expressed their interest in issuing electronic versions of their respective national fiat currencies, but none have gone further than the drawing board so far – but the BoG is proving once again to be ahead of most other peer countries when it comes to innovation.

Actually, the BoG’s initiative is being driven largely by its desire to head off trading in cryptocurrencies in Ghana which it regards as dangerously speculative, being unregulated and highly volatile. While cryptocurrencies – even bitcoin which is by far the most widely traded and used worldwide – are not accepted as payments anywhere in Ghana, trading in them has become increasingly popular.

“I think there is a lot more emphasis on looking at digital money which is backed by the state, backed by the central banks. These private forms of money really are not able to perform the functions of money effectively,” Dr Addison asserts. Addison also asserts that unregulated cryptocurrencies like bitcoin are “too volatile to play the function of money.”

Ghana is getting closer to issuing the digital cedi, but Dr Addison insists the process has to unfold in three phases to ensure BOG maintains its reputation as Africa’s leader when it comes to embracing emerging financial technologies.

“With these types of things, you have to go at it in phases and the first phase was really on the design of the electronic money and the team that has gone quite far in the design phase, they are looking at the implementation phase,” Addison said. Right now, digital currency is in a limited implementation phase, meaning that some online transactions will accept the digital currency if it’s applied to the payment.

Dr. Addision said that the Central Bank of Ghana will then determine, based on the implementation phase, whether it’s feasible to release the digital currency on a broader scale.

The next step will be a pilot phase “where a few people would be able to use the digital cedi on the mobile applications,” he added. “From that pilot, we will be able to determine whether this is feasible and what sort of things need to be tweaked to make it work effectively,” he said.

This is the phase which Dr Afari last week confirmed will commence before the end of the year.

Dr. Addision believes that this digital currency move is a way to move consumers away from decentralized cryptocurrency (such as Bitcoin) and toward a digital currency that is much more secure and centralized (thus giving its users more protections).

The Bank of Ghana was one of the first African central banks to declare it is working on a digital currency, but on a global basis, it is in good company. By the end of 2020, some 60 percent of the world’s central banks had said they were experimenting with national digital currencies and the number keeps rising; the proportion of central banks looking at issuing digital currencies by the end of last year was up 18 percent on the proportion as at a year earlier.

China is in the lead in this regard with a strong likelihood that it will have a fully fledged digital Yuan up and running by the time it hosts next year’s Winter Olympics, which would serve as a great opportunity to showcase it as the world’s first fully operational CBDC.

Several other central banks of major economies such as the Bank of England and the United States’ Federal Reserve Bank are also pursuing the issuance of digital versions of their respective national fiat currencies. In continental Europe, Sweden is in the lead, aggressively pursuing a digital version of its Krone, although the European Central Bank is not far behind, considering the issuance of a digital Euro.

Also, serious discussions about CBDCs have been gaining steam in smaller regions. By way of example, the Eastern Caribbean Central Bank (ECCB) debuted DCash, and the Central Bank of the Bahamas launched the Sand Dollar, a digital currency backed by that nation’s central bank.

For the major convertible currencies, they no longer have much choice in the matter as their chief competitors gear up to issue their respective digital versions. For instance, the European Central Bank cannot sit back and see the biggest two sovereign economic jurisdictions – the United States and China – issue digital versions of their respective currencies without competing on that level, more so with Britain, until recently a member of the EU itself, but now an independent competitor, also following the same route.

While these countries are working towards introducing national digital currencies as part of their efforts to defend and enhance their competitiveness as international convertible currencies used in cross border transactions worldwide – which has a host of advantages such as increased demand for a currency, which supports its exchange rate and the ability to borrow in one’s own currency – Ghana is necessarily less ambitious since the cedi is not internationally convertible.

For the BoG the main persuasion is the desire to pull its citizens away from trading in cryptocurrencies which, due to their volatility has lots of upside profit potential but equally large downside risk.

Even more importantly, the more cryptocurrency investment made in Ghana, the less control the BoG has over money supply and consequently the impact of its monetary policy.

Indeed, the BoG has actively resisted the embracing of cryptocurrencies since they became popular worldwide. As far back as January 2019 it issued a public notice warning against such activity. It said:

The Bank of Ghana has taken notice of recent developments in the use, holding, and trading of virtual or digital currencies (also known as cryptocurrencies), such as Bitcoin in Ghana. The Bank of Ghana wishes to notify the general public that these activities in digital currency are currently not licensed under the Payments System Act 2003 (Act 662). The Bank of Ghana is currently investing a lot of resources to further enhance the payments and settlements system, including digital forms of money and also to introduce cybersecurity guidelines to safeguard electronic and online financial transactions. A revised Payments System Act referred to as Payment Systems and Services Bill will be considered by Parliament within the next couple of months. This revision should bring the electronic payments space up to date to international standards and aligned with the evolving electronic payments landscape. While the Bank of Ghana acknowledges the enormous potential in the blockchain technology and how that can significantly transform the payments system landscape and promote financial inclusion, we are assessing with stakeholders and other international partners how the subsequent use of the blockchain technology into digital currencies would fit into the global financial and payments architecture. The public is therefore strongly encouraged to do business with only institutions licensed by the Bank of Ghana to ensure that such transactions fall under our regulatory purview. For the avoidance of doubt, the public can always consult our website (www.bog.gov.gh) for a list of licensed banks and non-bank financial institutions in Ghana. The Bank of Ghana assures the general public of its continuous efforts to safeguard the stability and soundness of the financial sector.

Instructively these regulations have since been introduced but without creating legal space for cryptocurrencies trading and use as a form of payments in Ghana. However, the Bank is willing to accept innovation with regards to financial products and services that use the underlying blockchain technology.

Indeed, BOG recently partnered with Emtech — a digital transformation consortium — to launch a sandbox targeting blockchain, central bank digital currencies (CBDCs), and financial inclusion.

The BoG has subsequently launched a fintech regulatory and innovation live testing pilot that will give preference to projects using blockchain technology.

According to the bank, the sandbox will cover a broad spectrum of innovations in the financial services sector, targeting women and improving financial inclusion in the country. The bank is on the lookout for remittance products, crowdfunding products and services, e-KYC (electronic know your customer) platforms and new merchant payment solutions for small to medium-sized businesses.

The sandbox will be available to banks, specialized deposit-taking institutions and payment service providers including dedicated electronic money issuers as well as unregulated entities.

Subsequently, EMTECH has launched a compliance platform in partnership with Microsoft that enables central banks to tackle compliance issues or safely test their central bank digital currencies (CBDCs).

The development and deployment of CBDC’s however pose numerous risks, including disintermediation, higher costs, volatility of deposit funding, and threats to financial anonymity. China has already suggested worldwide mandates regarding how CBDCs should operate.

Intense interest in cryptocurrencies and the Covid-19 pandemic have sparked debate among central banks on whether they should issue digital currencies of their own.

China has been in the lead in developing its own digital currency. It’s been working on the initiative since 2014. Chinese central bank officials have already conducted massive trials in major cities including Shenzhen, Chengdu and Hangzhou.

“China’s experiment is very large scale,” said J. Christopher Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission. “When the world arrives in Beijing next winter for the Winter Olympics, they are going to be using the new digital renminbi to shop and to stay in hotels and to buy meals in restaurants. The world is going to see a functioning [central bank digital currency] very soon, within the coming year.”

The U.S. is playing catch-up. In late February 2021, Fed Chairman Jerome Powell said the U.S. will engage with the public on the digital dollar this year.

Advocates contend central bank digital currencies can make cross-border transactions easier, promote financial inclusion and provide payment system stability. There are also privacy and surveillance risks with government-issued digital currencies. And in times of economic uncertainty, people may be more likely to pull their funds from commercial banks, accelerating a bank run.

Digital currency is a form of currency that is available only in digital or electronic form, and not in physical form. It is also called digital money, electronic money, electronic currency, or cyber cash.

Key Takeaways

- Digital currencies are currencies that are only accessible with computers or mobile phones, as they only exist in electronic form.

- Since digital currencies require no intermediary, they are often the cheapest method to trade currencies.

- All cryptocurrencies are digital currencies, but not all digital currencies are crypto.

- Digital currencies are stable and are traded with the markets, whereas cryptocurrencies are traded via consumer sentiment and psychological triggers in price movement.

Digital currencies are intangible and can only be owned and transacted in by using computers or electronic wallets connected to the Internet or the designated networks. In contrast, physical currencies, like banknotes and minted coins, are tangible and transactions are possible only by their holders who have their physical ownership.

Like any standard fiat currency, digital currencies can be used to purchase goods as well as to pay for services, though they can also find restricted use among certain online communities, like gaming sites, gambling portals, or social networks.

Digital currencies have all intrinsic properties like physical currency, and they allow for instantaneous transactions that can be seamlessly executed for making payments across borders when connected to supported devices and networks.

For instance, it is possible for an American to make payments in digital currency to a distant counterparty residing in Singapore, provided that they both are connected to the same network required for transacting in the digital currency.

Digital currencies offer numerous advantages. As payments in digital currencies are made directly between the transacting parties without the need of any intermediaries, the transactions are usually instantaneous and low-cost. This fares better compared to traditional payment methods that involve banks or clearing houses. Digital currency-based electronic transactions also bring in the necessary record keeping and transparency in dealings.

Since they exist in a lot of variants, digital currencies can be considered a superset of virtual currencies and cryptocurrencies.

If issued by a central bank of a country in a regulated form, it is called the “Central Bank Digital Currency (CBDC).”

Along with the regulated CBDC, a digital currency can also exist in an unregulated form. In the latter case, it qualifies for being called a virtual currency and may be under the control of the currency developer(s), the founding organization, or the defined network protocol, instead of being controlled by a centralized regulator. Examples of such virtual currencies include cryptocurrencies, and coupon- or rewards-linked monetary systems.

Since cryptocurrencies are unregulated, they are also considered to be virtual currencies.

A cryptocurrency is another form of digital currency which uses cryptography to secure and verify transactions and to manage and control the creation of new currency units. Bitcoin and ethereum are the most popular cryptocurrencies.

Essentially, both virtual currencies and cryptocurrencies are considered forms of digital currencies.