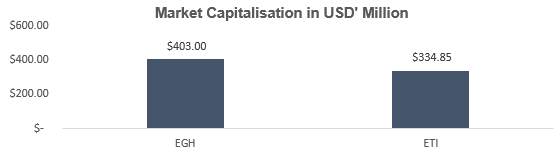

Summary: ETI’s share price has returned a disappointing -262.5 percent to shareholders since its listing by introduction in 2006 (2006: GHc 0.29p; 2020: GHc 0.08p) at its current market capitalisation of GHc 1.92 billion (US$ 334.85 million). Astonishingly, the Group’s Ghanaian subsidiary which represents 7.19 percent of the Group’s operating assets, commands an enviable market capitalisation of GHc 2.32 billion (US$ 403 million) representing a total return of 1,209.5 percent.

This article seeks to analyse the areas of value destruction for the Ecobank Group, opportunities for restoring shareholders value and available capital market tools to assist the group in restructuring its business

Following a deep assessment of the Group’s business model and historical financial statements, it was discovered that the Group’s key problems and value destructors remains its poor geographical diversification, sector concentration and asset quality issues.

Therefore it has become a necessity for the Group to consider deleveraging and diversifying its concentration in Nigeria, which presents formidable idiosyncratic risk for the entire Group’s business model. In addition, the company should consider implementing the recommended measures (in this article) in order to reduce its translation and impairment losses.

Introduction: The African rising narrative would have remained incomplete without the listing of Ecobank Transnational Incorporated (ETI) on three West African Bourses (BRVM, GSE & NSE) in 2006. Surprisingly, the euphoria of sharing in the value of this Pan African banking holding group was short-lived as the company consistently battled with asset quality problems, corporate governance issues and internal rivalry that collectively contributed to significant losses in shareholder value. Since its listing by introduction in 2006, ETI’s share price has returned a disappointing -262.5 percent to shareholders (2006: GHc 0.29p; 2020: GHc 0.08p).

Astonishingly, the Group’s Ghanaian subsidiary on the other hand continues to do incredibly well in enhancing shareholder value in a competitive domestic banking industry. Ecobank Ghana (EGH) is currently more valuable in terms of market capitalisation than the entire ETI (EGH: Market Cap of GHc 2.32 billion, ETI: Market Capitalisation of GHc 1.92 billion).This cannot be attributed to a mere valuation flaw but rather a justification for EGH’s continuous increase in shareholders’ value. Following its listing, together with the mother company in 2006, EGH has returned a total of 1,209.5 percent to shareholders. (EGH Market Cap increased from GHc 177.34 million in 2006 to GHc 2.32 billion in 2021)

This article seeks to analyse the areas of value destruction for the Ecobank Group, opportunities for restoring shareholders value and available capital market tools to assist the group in restructuring its business to consistently generate profits that can help to unleash the true value of the company.

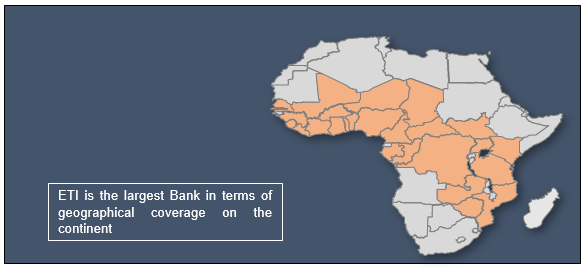

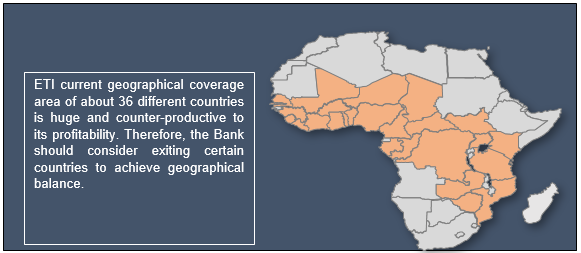

About the Company: ETI is the holding company of the pan-African baking group, Ecobank. It is a public limited liability company that was established as a bank holding company in 1985 under a private sector initiative spearheaded by the Federation of West African Chambers of Commerce and Industry with the support of the Economic Community of West African States (ECOWAS).Today, Ecobank is the leading pan-African bank with operations in 36 countries across the continent. It has a larger African footprint than any other bank in the world. The Group also has representative offices in Paris, Beijing, Dubai, Johannesburg, London and Luanda.

The Conundrum & Flaw

ETI was listed on three different exchanges to provide investors the opportunity to invest in the company across West Africa. The company listed its shares at a price of GHc0.29p (US$ 0.29 cents) per share with a market capitalisation of approximately GHc 1.69 billion (US$ 1.69 billion) in 2006. Today, ETI’s shares sell for a giveaway price of GHc 0.08p with a market capitalisation of GHc 1.92 billion (US$ 334.85 million), which represents a total decline of 265 percent in shareholders’ value. At the same time, Ecobank Ghana, which represents 7.19 percent of the Group’s operating assets, commands an enviable market capitalisation of GHc 2.32 billion (US$ 403 million). Meaning Ecobank Ghana is technically valuable and bigger than the entire Ecobank Group.

Challenges & Value Destructors

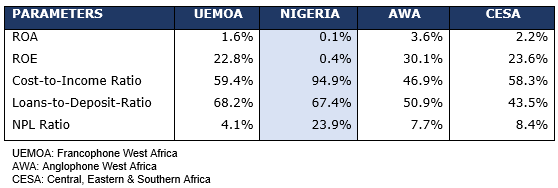

Following a deep assessment of the Group’s business model and historical financial statements, it was discovered that the Group’s key problems and value destructor remains its poor geographical diversification, sector concentration and asset quality issues. As banal as it may sound, these factors continue to pose challenges to the Group’s profitability and shareholders’ value. Below are a breakdown of the key challenges to the Group’s profitability and shareholders value;

(a) Poor geographical diversification & credit concentration: ETI’s business operations is significantly influenced by its material subsidiary Ecobank Nigeria (ENG), which accounted for approximately 23 percent of the group’s operating assets as at Q3-2020. This is equivalent to the combined operating assets of the Group’s subsidiaries in the entire Central, Eastern & Sourthern Africa (CESA) region and significantly larger than the Group’s combined business operations in the Anglophone West African Region (Ghana, Liberia, Sierra Leone, The Gambia & Guinea Bissau). The firm’s performance continues to be inextricably tied to the economic fortunes of its Nigerian subsidiary. Unfortunately, ENG continues to face formidable asset quality challenges, with stage 3 and stage 2 loans representing 23.3 percent and 26.2 percent of the subsidiary’s gross loans respectively as at Q3-2020. In addition, the Group’s high oil sector allocation and single obligor concentrations, particularly to Nigeria’s troubled oil sector continues to create impairment issues and huge write-offs on group’s profitability. Impairment losses on loan portfolio outstanding for the group stood at US$ 133.55 million as at 2019 and US$ 387 million as at Q3-2020. One may ask why the overconcentration in Nigeria should be an issue, after all there exist several Pan-African Nigerian Banks (Zenith Bank Plc, GT-Bank Plc, UBA, etc) with significant exposure to Nigeria and the oil sector but still doing incredibly well. This concern is addressed in our next identified challenge below.

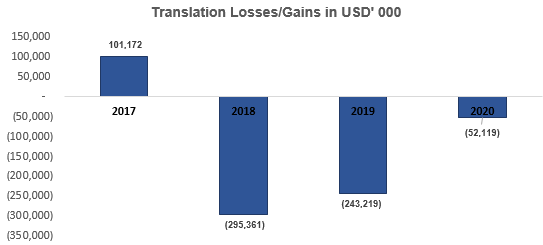

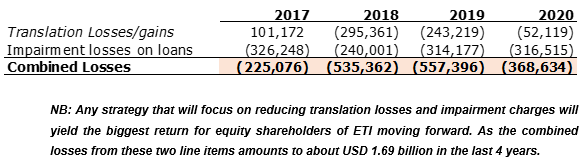

(b) Translation losses emanating from the consolidation of subsidiaries’ financial statement into reporting currency of the Group Company: Because ETI’s operations is spread across several countries within the sub-Saharan Africa, its chosen reporting currency is in USD. Ideally, given that the company is headquartered in Togo one would have expected the reporting currency for the Group to have been the West Africa CFA franc, which isn’t so. The choice of USD as the reporting currency, coupled with ETI’s significant exposure to the Naira currency through its Nigerian subsidiary (which was about 40 percent in 2015) exposed the firm to significant translation losses (exchange rate volatility) over the years, which resulted in huge shareholder losses as reported profit declines. ETI’s exchange differences, on translation of foreign operations or exchange rate losses averaged US$ 243 million in 2019 and US$ 295 million in 2018. Surely the negative translation effect owes to a poor geographical diversification which constrained the firm from benefiting from the positive impact of cross currency effect (where currency depreciation and appreciations offset one another to generate a stable currency impact). Now, because most Pan-African Nigerian Banks consolidate their financials into the naira reporting currency, a depreciating Naira works to the advantage of these companies as translation gains are made from the business operations of subsidiaries operating in strong currency regimes, while it unfairly penalizes shareholders of ETI, given equal geographic and sectorial exposures. Most of the reported translation losses eating shareholders value could have easily been averted with a good choice of reporting currency. One may ask, how come institutions such as Afrexim & African Finance Corporation whose reporting currency is the USD doesn’t record such significant translation losses? This issue is addressed in our next identified challenge below.

(c) Decision to completely ignore big economies of the Southern & Northern Africa: ETI has licensed operation in Paris and representative offices in Beijing, Dubai, Johannesburg, London and Luanda. However, the Bank does not operate a functioning commercial banking business in these jurisdictions. In addition, a critical look at the geographical distribution of the Bank’s operations indicate that the Bank strategically ignored the far developed economies of Northern & Southern Africa (South Africa, Bostwana, Namibia & Mauritius) where the Bank can benefit from strong economies and relatively stable currency regimes. This sole decision has affected the bank’s profitability and forex gains. For example, the likes of Africa Finance Corporation, which invest in infrastructure projects across Africa, has a significant allocation to the North & Southern regions of Africa and same for Afrexim Bank. Admittedly, their business models differ slightly and are more dollar defensive. However, peers such as BMCE Bank is heavily diversified across the Northern Africa region whiles Standard Group commands a solid base in Southern Africa. To ensure profitability in a volatile operating environment like Sub-Saharan Africa, the Group must further push for proper geographical diversification to neutralize or reduce the idiosyncratic risk.

Capital Market tools to unravel Value for ETI

(1) Work towards deleveraging and reducing the geographical concentration of its material subsidiary, ENG: Given the structural risk that the operational and sectorial concentration of ETI’s Nigerian subsidiary presents, it has become imperative for the Group to focus its attention on restructuring its Oil & Gas loans to improve the credit profile of the bank while at the same time reducing its exposure to the West African country. I propose that shareholders of the Group should consider reducing its equity position in the Nigerian subsidiary from a 100 percent ownership percentage to approximately 50 percent or less, to represent an associate firm other than a full subsidiary company. This could be done through an outright sale of group’s ownership interest or through a merger with an indigenous competitor. The pros of an outright sale is that it will free up cash for the Group. This will enable it to fund its expansion works into other profitable territories and further reduce its double leverage position with enhanced credit rating. On the other hand, a merger will also help the Group benefit from synergy, which could reduce cost, improve efficiency ratios and further accelerate realization of profit moving forward. Also, given ENG’s asset quality issues and operational losses, there exist a possibility of equity capital injection in the future to shore-up the subsidiary’s CAR, especially if the Covid-19 pandemic persists. Therefore a merger with a good candidate will forestall this anticipated problem. If expansion is not an option for the Group now, it might consider exiting inefficient subsidiaries in an effort to optimize its operations and boost profitability.

(2) De-list, Restructure the Business and Re-list on either GSE, NSE or BRVM -but not all – with Naira, Cedi or CFA Franc as the reporting currency: ETI’s current market value or share price is significantly undervalued and offers a very deep discount to its intrinsic value, akin to a penny stock with a strong potential to rebound. In addition, the multiple listing status of the Bank (ETI trades in three different Bourses under three different currency regimes) is counterproductive to the realization of true shareholders’ value, as all shares prices at any point in time must trade in synchrony to ensure all arbitrage positions are wiped off completely. At a point in time, shares of ETI were moving between the Exchanges of listed countries causing illiquidity and mispricing in certain countries. A de-listing of the Group will afford Management and Board the opportunity to restructure the business within a period of three years and re-list the entire group in just one of the following countries (Ghana, Nigeria or BRVN). Ideally, I prefer ETI listing on the Ghana Stock Exchange or Nigeria Stock Exchange where they can benefit from the relative depreciation effect of their local currencies. This will help the company to record less translation losses and even record translation gains when the cedi is depreciating.

(3) Convince two of its existing shareholders (Qatar National Bank Q.P.S.C and Public Investment Corporation of South Africa) to convert a portion of its USS 400 million convertible bond into equity following de-listing: With ETI’s Capital Adequacy Ratio lingering slightly above the regulatory accepted threshold of 10 percent, the group will have to shore-up its CAR following de-listing or while listed, moving forward. The conversion of a portion of the Group’s convertible bond outstanding will free up cash and improve the profitability of the firm and shareholders’ value (in the form of retained earnings). This would improve the group’s profitability, solvency and risk ratings which would collectively present a compelling case for higher valuation in the re-listing of the company.

Conclusion

ETI possess enormous potential to unleash shareholders value. It remains a solid brand in the minds of Sub-Saharan African consumers, with a strong goodwill that can easily be capitalised to generate shareholders value. I will encourage management of the firm and board to take steps in implementing the proposed recommendations above, which I believe will help the Firm in unravelling its true value as the leading Pan African Bank.

Disclaimer This article was prepared by Emmanuel O. Boakye in his personal capacity. The opinion expressed in this article are the author’s own and do not reflect the view of his employer. Information and opinion herein has been compiled or arrived at based on information obtain from sources considered reliable. I therefore do not hold myself responsible for its completeness or accuracy. All statement of opinion, projections, forecast, or those relating to expectations regarding future events or performance of investments represents my own assessment and interpretation of information currently available, which are subject to change