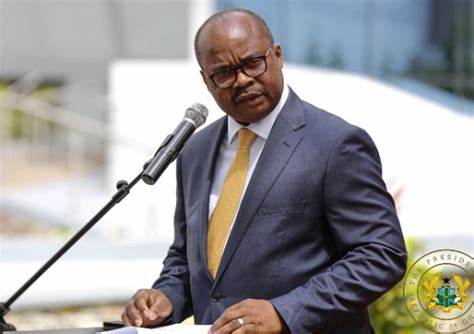

The Governor of the Bank of Ghana, Dr. Ernest Addison, says the performance of banks during the first half of 2023 looks promising despite the impact of the Domestic Debt Exchange Programme (DDEP) on profitability and solvency of banks in 2022.

Though he agrees that the Ghanaian economy is currently undergoing some adjustments, which calls for innovation and creativity in business conduct, especially in the banking sector, the banking industry will rebound, he disclosed at the 70th Anniversary Celebrations of GCB Bank.

“The Domestic Debt Exchange Programme (DDEP) affected profitability and solvency of banks in 2022, but performance of banks during the first half of 2023 looks promising. The Bank of Ghana has also granted some temporary regulatory reliefs to dampen the impact of the debt restructuring and these, together with the expected operationalization of the Ghana Financial Stability Fund, should provide adequate support to the banking sector. Furthermore, banks whose CAR [Capital Adequacy Ratio] levels have dropped below the 10% minimum due to the DDEP have been advised to provide recapitalisation plans for review”.

The Governor meanwhile commended the shareholders of GCB Bank on agreeing to allow the bank to raise additional capital of ȼ1.0 billion to meet regulatory capital adequacy ratio requirements.

He also applauded the shareholders for enhancing the bank’s deal-making capacity and take advantage of opportunities available to the bank while preserving the bank’s core strengths, strengthen access to funding markets and bolster confidence in the bank and support targeted and prioritized investment in digital transformation and ultimately help to drive the bank’s business strategy.

He also believed GCB Bank will surmount all the emerging economic and financial challenges, given the collaboration between the regulator, on the one hand, and directors and shareholders of GCB Bank, on the other hand.

Chronicling the banks achievement so far, Dr. Addison, said it is also refreshing to note that GCB Bank has taken cyber security issues very seriously, with some major milestones. These include being the first financial institution in Ghana with a Security Operations Centre (SOC) to become a full member of the Forum for Incident Response and Security Teams (FIRST).

In the drive towards innovation, GCB Bank launched Ghana’s first bank-led mobile money service, that is, G-Money, which currently serves more than 2.7 million customers with services such as money transfer, bill payments, etc.

All these strides, the Governor said, have earned the bank recognition, including being adjudged the top financial services firm at the 2022 Ghana Club 100 Awards. The Bank ranked first in the banking sector and tenth in the list of 100 topmost prestigious companies in Ghana.