Toyota is to slash worldwide vehicle production by 40% in September because of the global microchip shortage.

The world’s biggest carmaker had planned to make almost 900,000 cars next month, but has now reduced that to 540,000 vehicles.

Volkswagen, the world’s second-biggest car producer, has warned it may also be forced to cut output further.

The Covid pandemic boosted demand for appliances that use chips, such as phones, TVs and games consoles.

On Thursday, German firm Volkswagen, which cut output earlier in the year, told Reuters: “We currently expect supply of chips in the third quarter to be very volatile and tight.

“We can’t rule out further changes to production.”

Toyota’s other rivals, including General Motors, Ford, Nissan, Daimler, BMW and Renault, have already scaled back production in the face of the global chip shortage.

Until now, Toyota had managed to avoid doing the same, with the exception of extending summer shutdowns by a week in France the Czech Republic and Turkey.

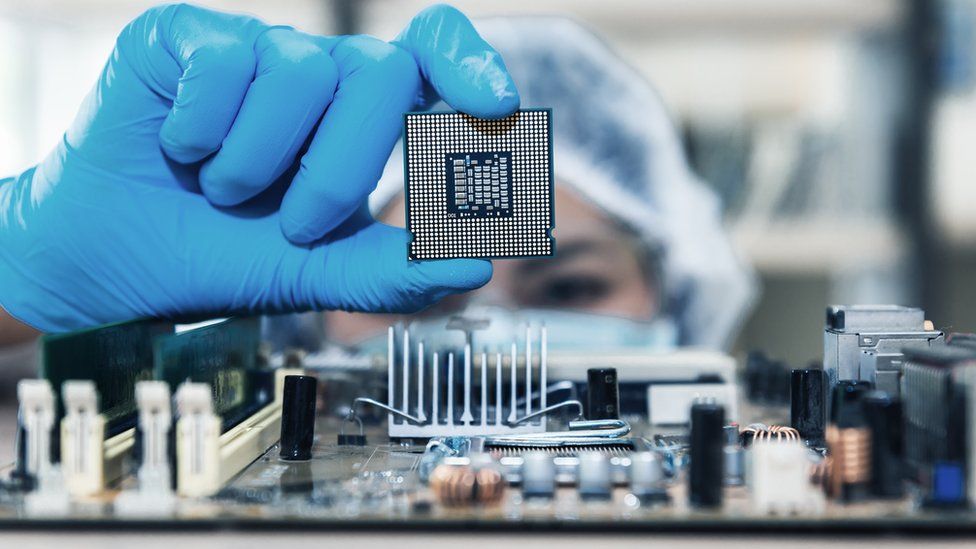

New cars often include dozens of microchips but Toyota benefited from having built a larger stockpile of chips – also called semiconductors – as part of a revamp to its business continuity plan, developed in the wake of the Fukushima earthquake and tsunami a decade ago.

The decision to reduce output now has been precipitated by the resurgence of coronavirus cases across Asia hitting supplies.

The company will make some cuts in August at its plants in Japan and elsewhere.

The bulk of the cuts – 360,000 – will come in September and affect factories in Asia and the US.

In the UK, Toyota has a car plant at Burnaston, in Derbyshire, and an engine plant on Deeside. In a statement, it said: “Toyota is going to great lengths to minimise the impact of the semi-conductor supply shortage that is globally impacting the automotive industry.

“In terms of our UK production operations, we are currently operating as planned at both plants.”

The aim for Toyota as a whole is to make up for any lost volume by the end of 2021.

A wide range of businesses from car makers to small appliance manufacturers have been hit by the chip shortage.

Issues started to emerge last year when Apple had to stagger the release of its iPhones, while the latest Xbox and PlayStation consoles failed to meet demand.

Since then, one technology company after another has warned of the effects.

And last month, the boss of chipmaker Intel, Pat Gelsinger, said the worst of the global chip crisis was yet to come.

Mr Gelsinger predicted the shortage would get worse in the “second half of this year” and it would be “a year or two” before supplies returned to normal.

The shortage prompted US President Joe Biden to sign an executive order to address the issue. He vowed to seek $37bn in funding for legislation to increase chip manufacturing in the US.

Shares in Toyota fell by 4.4% on Thursday, their biggest daily drop since December 2018.

How the shortage is affecting firms:

- Renault forecasts its car production could be down by about 100,000 this year

- Sony says it is difficult for it to bump up production of the PS5 consoles

- Apple expects the impact of the shortage to worsen and extend to iPhone production

- Tesla says it is using alternative chips and rewriting software

- Taiwan Semiconductor Manufacturing plans to build new factories in the US and Japan